Introduction

In today’s volatile financial landscape, businesses must navigate uncertainties while striving for growth. The Risk Appetite Statement (RAS) plays a crucial role in helping organizations define their tolerance for risk and align it with their strategic objectives. But what exactly is a Risk Appetite Statement, and why is it essential for corporate governance, financial institutions, and risk management frameworks?

This comprehensive study explores the concept of Risk Appetite Statements (RAS), best practices for crafting an effective RAS, and real-world business scenarios illustrating its impact. We’ll also highlight examples from leading financial institutions and conclude with practical insights on integrating risk appetite into your organization’s decision-making process.

What is a Risk Appetite Statement?

A Risk Appetite Statement (RAS) is a formal document outlining an organization’s acceptable level of risk exposure in pursuit of its objectives. It serves as a guiding framework for decision-making, ensuring that the organization maintains a balanced approach to risk-taking.

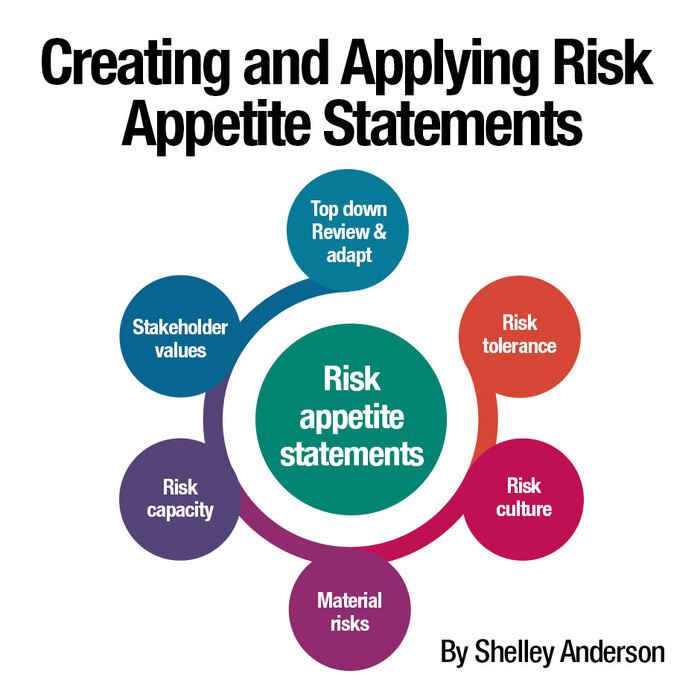

Key Components of a Risk Appetite Statement

- Risk Capacity – The maximum risk the organization can handle without jeopardizing its financial stability.

- Risk Tolerance – The acceptable deviation from risk appetite before corrective action is required.

- Risk Limits – Specific thresholds that define boundaries for various risk categories.

- Risk Culture & Governance – Roles and responsibilities of the Board of Directors, Risk Committee, and Senior Management in enforcing risk appetite.

- Scenario-Based Risk Analysis – Stress testing, forecasting, and data-driven insights to ensure preparedness for any kind of financial shocks.

Why Do Organizations Need a Risk Appetite Statement?

A well-defined Risk Appetite Statement ensures that companies can mitigate risks proactively while seizing profitable opportunities. Without a structured approach, businesses face exposure to risks that can result in financial losses, regulatory violations, and reputational damage.

Key Benefits of having a risk appetite statement in any organization.

✅ Aligns risk-taking with corporate strategy

✅ Enhances regulatory compliance (e.g., Basel III, IFRS 9)

✅ Improves decision-making by defining clear risk boundaries

✅ Strengthens investor and stakeholder confidence

✅ Helps in crisis management and stress testing

Business Scenarios: How Risk Appetite Impacts Decision-Making

To illustrate the importance of Risk Appetite Statements, let’s explore real-world business case studies where risk appetite played a crucial role. These examples will help you understand the objectives and benefits of Risk Appetite statement and you can easily co-relate whether it makes sense to create one for your organization or not.

Banking & Financial Institutions – Managing Credit & Market Risks

📌 Scenario: A global bank wants to expand into emerging markets but is concerned about high credit risk.

✅ Risk Appetite Statement Impact:

The bank defines its risk appetite as:

- Maximum loan-to-value (LTV) ratio: 75%

- Maximum exposure to subprime borrowers: 10% of total portfolio

- Risk-adjusted return on capital (RAROC) threshold: ≥ 12%

📊 Outcome: By setting clear risk limits, the bank mitigates its exposure to high-risk markets while ensuring profitable lending operations.

Tech & AI Startups – Balancing Innovation with Risk

📌 Scenario: A SaaS (Software-as-a-Service) startup is developing an AI-powered fintech app but faces cybersecurity and data privacy risks.

✅ Risk Appetite Strategy:

- Data security risk: Acceptable breach probability below 0.01%

- Regulatory risk: No tolerance for non-compliance with GDPR, CCPA

- Operational risk: Maximum downtime limit of 3 hours per year

📊 Outcome: The startup aligns risk appetite with compliance frameworks while maintaining a competitive edge in innovation.

E-Commerce – Managing Supply Chain & Operational Risks

📌 Scenario: An online retailer depends on third-party logistics (3PL) for product delivery but experiences frequent supply chain disruptions.

✅ Risk Appetite Adjustments:

- Supplier risk concentration limit: No single supplier should account for more than 30% of total shipments

- Inventory risk tolerance: Maintain buffer stock for at least 3 months

- Market expansion risk: Growth into new markets only if operational costs remain below 10% of revenue

📊 Outcome: The company reduces its dependence on a single supplier and ensures resilience against disruptions.

Best Practices for Crafting an Effective Risk Appetite Statement

Since, we have understood the definition, components and use-cases for appetite statements, let us further dive into the best practices for crafting the statements so that it will be easy, structured and goal-oriented.

Align with Business Objectives

A Risk Appetite Statement should reflect corporate strategy, ensuring that risk-taking aligns with the organization’s mission and financial goals. The major benefit of starting with this step is to have a clear-cut alignment with “Vision shared” and “Shared Vision”. Risk appetite statement cannot be developed in SILO, it should be inter-linked with company/ organization’s vision.

Use Quantifiable Metrics

A vague risk appetite statement like “We have a low risk tolerance” is ineffective. Instead, use clear thresholds, such as:

❌ Weak: We aim to minimize cybersecurity risks.

✅ Strong: We will maintain a cybersecurity breach probability of less than 0.5% annually.

This will give a reading/ indicator to look for in the overall performance.

Define Escalation Protocols

Risk limits should have clear action plans in case they are breached. For example:

- If liquidity risk exceeds 5% of total capital, the CFO must report to the Board within 24 hours.

- If market risk breaches defined thresholds, the Risk Committee will reassess portfolio diversification strategies.

In the event of crisis, it will be very clear on the steps / personnel to approach for timely resolution/ escalation. This also helps in Business continuity management.

Conduct Regular Reviews & Stress Testing

Risk appetite should be dynamic, not static. Regular stress tests and scenario analyses help organizations adapt to economic fluctuations and regulatory changes. With changing business environment, it is essential to have policies, procedures and framework which is resilient and dynamic.

How Leading Organizations Use Risk Appetite Frameworks

Many top financial and regulatory institutions implement structured Risk Appetite Statements. Some notable examples include:

- European Bank for Reconstruction and Development (EBRD) – Uses quantitative risk appetite statements to guide investment decisions.

- USAID Risk Appetite Statement (2022) – Defines acceptable risk levels in international development projects.

- Green Climate Fund (2024) – Integrates climate risk into financial decision-making.

Risk Appetite in the Age of AI & Digital Transformation

With the rise of Artificial Intelligence (AI) and Big Data, risk appetite frameworks are evolving. AI-driven risk assessment models help organizations:

📌 Predict market fluctuations using machine learning algorithms

📌 Automate compliance monitoring with AI-powered risk dashboards

📌 Analyze risk tolerance in real-time for dynamic decision-making

Companies adopting AI in risk management can enhance efficiency, reduce human error, and improve risk forecasting.

Why Risk Appetite Matters for Business Growth

A well-defined Risk Appetite Statement is essential for corporate governance, financial planning, and regulatory compliance. Whether you’re in banking, tech, or retail, understanding your risk capacity and tolerance helps you balance growth with stability.

By implementing an effective Risk Appetite Framework, businesses can seize opportunities while safeguarding against unforeseen risks.

References & Further Reading

Below is the list of references 📚 for your reading and sources used while curating this article.

- How to draft risk appetite statements

- Risk Appetite Statements: Best Practices & Latest Research (Gaby Frangieh, 2024)

- FSB Principles for Effective Risk Appetite Frameworks (Financial Stability Board, 2013)

- Basel III Framework – www.bis.org

- International Risk Management Institute (IRMI) – www.irmi.com

- ISO 31000 Risk Management Guidelines – www.iso.org