Introduction

In an increasingly volatile business landscape, organizations must strike a balance between growth opportunities and risk exposure. A Risk Appetite Statement (RAS) serves as a strategic blueprint that defines the level of risk an organization is willing to accept while pursuing its objectives.

Whether you run a bank, tech startup, healthcare company, or e-commerce business, a well-drafted Risk Appetite Statement ensures financial stability, regulatory compliance, and informed decision-making.

This comprehensive guide walks you through seven key steps to drafting a robust Risk Appetite Statement with real-world examples for various industries. 🚀

Step 1: Define Business Objectives & Strategic Goals

Your Risk Appetite Statement should align with your business vision, mission, and objectives. If your organization prioritizes aggressive growth, your risk appetite will differ from a company focusing on stability and compliance.

📌 Example:

- A FinTech startup aiming for rapid expansion into multiple markets may have a high-risk appetite for market volatility but a low-risk appetite for regulatory compliance risks.

- A healthcare company will likely have a low-risk appetite for medical errors but a moderate risk appetite for operational risks.

✅ Actionable Steps:

- Identify core business objectives (e.g., market expansion, innovation, revenue growth).

- Assess how risk-taking supports or hinders these goals.

- Engage stakeholders (executives, board members, risk managers) to align risk appetite with strategy.

Step 2: Categorize and Prioritize Key Risks

Businesses face multiple types of risks, including financial, operational, compliance, reputational, and strategic risks. Categorizing and prioritizing risks helps organizations allocate resources effectively.

📌 Example:

E-Commerce Company

- High Risk Appetite: Digital marketing experiments & customer acquisition strategies.

- Low Risk Appetite: Cybersecurity breaches and supply chain disruptions.

Banking Sector

- High Risk Appetite: Market and investment risk (calculated exposure).

- Low Risk Appetite: Credit risk and regulatory non-compliance.

✅ Actionable Steps:

- Identify key risk categories relevant to your industry.

- Prioritize risks based on impact and likelihood.

- Determine risk interdependencies to assess cascading effects.

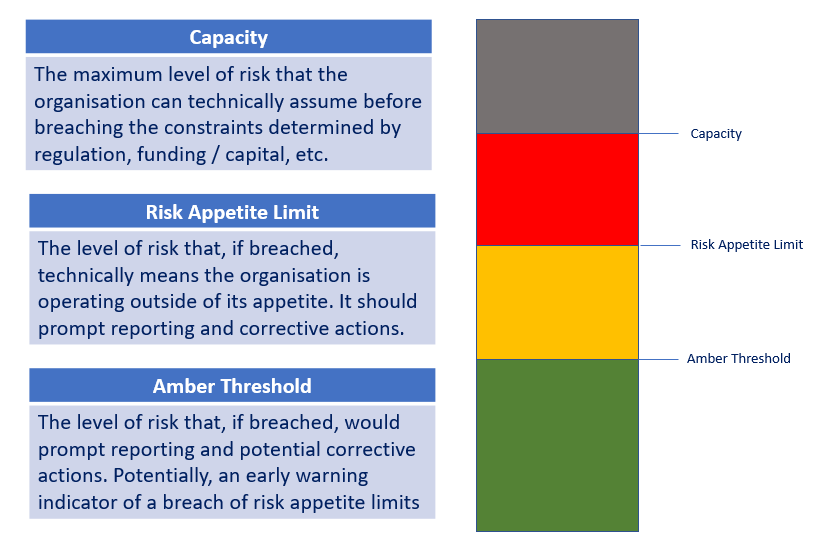

Step 3: Define Risk Tolerance and Risk Limits

Risk appetite is abstract without defining quantifiable risk limits. Setting clear risk tolerance thresholds prevents excessive risk-taking and ensures that risk is measurable.

📌 Example:

✅ Manufacturing Company

- Operational Risk Limit: Downtime should not exceed 1% of total production time per month.

- Supply Chain Risk Tolerance: Not more than 30% dependence on a single supplier.

✅ FinTech Firm

- Cybersecurity Risk Tolerance: System breaches should not exceed 0.1% of total transactions.

- Liquidity Risk Limit: Minimum cash reserves of $5 million at all times.

✅ Actionable Steps:

- Set quantifiable risk thresholds for key risks.

- Establish upper and lower limits for acceptable risk-taking.

- Regularly review risk limits based on market conditions.

Step 4: Establish Roles & Responsibilities in Risk Management

A strong governance structure ensures risk appetite is implemented, monitored, and adjusted effectively.

📌 Example:

✅ A large bank has:

- Board of Directors – Approves and oversees the Risk Appetite Framework.

- Chief Risk Officer (CRO) – Ensures adherence to risk policies.

- Business Unit Heads – Implement risk controls within departments.

✅ Actionable Steps:

- Define roles & responsibilities for risk governance.

- Ensure senior management and the board are accountable for enforcing risk appetite.

- Assign risk monitoring duties to dedicated personnel.

Step 5: Integrate Risk Appetite into Decision-Making

A Risk Appetite Statement should be a living document, guiding everyday business decisions.

📌 Example:

✅ A retail chain expanding into a new market uses risk appetite to:

- Assess real estate investment risks.

- Determine acceptable market penetration costs.

- Weigh the risk of supplier dependency.

✅ Actionable Steps:

- Integrate risk appetite into investment, hiring, product development, and financial strategies.

- Establish risk tolerance guidelines for decision-making.

- Train employees to align operational activities with risk appetite.

Step 6: Monitor, Review, and Update Regularly

Risk appetite should evolve based on market conditions, regulatory changes, and business growth.

📌 Example:

✅ A SaaS startup adjusts its risk appetite quarterly to:

- Increase tolerance for new technology adoption.

- Reduce risk limits for customer churn rates.

✅ Actionable Steps:

- Conduct quarterly risk reviews.

- Perform stress testing & scenario analysis.

- Update the Risk Appetite Statement as market conditions change.

Step 7: Communicate and Report Risk Appetite Effectively

Transparency in risk communication ensures stakeholders, employees, and investors understand risk boundaries.

📌 Example:

✅ An investment firm includes risk reports in shareholder updates:

- Highlights risk performance metrics.

- Explains adjustments in risk appetite due to economic conditions.

✅ Actionable Steps:

- Develop clear reporting mechanisms for risk appetite.

- Use dashboards, reports, and presentations to communicate risk.

- Ensure regulatory compliance with disclosure requirements.

📊 [Summary] Key Steps to Drafting a Risk Appetite Statement

| Step | Description | Example |

|---|---|---|

| 1. Define Business Objectives | Align risk appetite with strategic goals | A FinTech startup with aggressive expansion |

| 2. Categorize Risks | Identify key risk areas (financial, operational, compliance) | E-commerce supply chain vs. cybersecurity risks |

| 3. Set Risk Tolerance & Limits | Establish measurable thresholds for acceptable risk | Liquidity buffer in banking |

| 4. Assign Roles & Responsibilities | Define governance structures for risk management | Board & CRO responsibilities |

| 5. Integrate into Decision-Making | Embed risk appetite in strategic & operational planning | Retail expansion assessment |

| 6. Monitor & Update Regularly | Adapt to market changes, regulatory shifts, and stress testing | Quarterly risk reviews for startups |

| 7. Communicate & Report Risks | Ensure stakeholders understand risk tolerance | Shareholder reports in investment firms |

Final Thoughts

A well-crafted Risk Appetite Statement is a powerful tool for strategic risk management. Whether you’re in finance, tech, healthcare, or retail, defining clear risk boundaries enables better decision-making, financial stability, and regulatory compliance.

Is your company prepared to draft a risk appetite framework? If you need expert guidance, contact us today for a tailored risk management strategy! 🚀

References & Further Reading

- Risk Appetite Statements: Best Practices & Latest Research (Gaby Frangieh, 2024)

- Principles for An Effective Risk Appetite Framework (FSB, 2013)

- ISO 31000 Risk Management Guidelines – www.iso.org

- Basel III Framework – www.bis.org

- Financial Stability Board (FSB) Reports – www.fsb.org

- Understanding Risk Appetite Statements