Background

Contract assets and contract liabilities play a crucial role in accurate revenue recognition under IFRS 15 (Revenue from Contracts with Customers). They determine whether a company has earned revenue but has not yet received full payment or whether it has received payment before delivering goods or services.

For internal auditors, misclassification of contract assets and liabilities can lead to financial misstatements, compliance risks, and regulatory scrutiny. Auditors need to assess whether the company is recognizing revenue at the correct time, ensuring that revenue is neither understated nor overstated.

This article provides a decision tree approach to help businesses and auditors classify transactions as contract assets or contract liabilities, with practical examples and audit strategies for ensuring IFRS 15 compliance.

Understanding Contract Assets and Contract Liabilities

Contract Assets: Definition and Characteristics

A contract asset arises when a company has performed work under a contract (i.e., transferred goods or services to a customer) but is not yet entitled to full payment because of conditions related to performance obligations. Learn about contract modification and revenue recognition in IFRS 15.

Key Characteristics of Contract Assets:

- The company has recognized revenue for work completed.

- Payment is conditional upon meeting further milestones.

- The company has not yet invoiced the customer for the completed work.

- The right to payment is dependent on future events, such as final project approvals.

| Scenario | Contract Asset Treatment |

|---|---|

| A construction company has completed 50% of a project but can only invoice at 75% completion. | Recognize a contract asset for the 50% work done that is not yet billable. |

| A software company has delivered a SaaS product but can only bill after a trial period. | Recognize a contract asset for the service already provided. |

Contract Liabilities: Definition and Characteristics

A contract liability arises when a company receives payment from a customer before fulfilling its performance obligations.

Key Characteristics of Contract Liabilities:

- The company has collected cash in advance before delivering goods or services.

- The company still owes the customer a product or service.

- Revenue must be deferred until the obligation is satisfied.

| Scenario | Contract Liability Treatment |

|---|---|

| A software company receives $12,000 upfront for a one-year subscription service. | The full amount is a contract liability, with $1,000 recognized as revenue each month. |

| An airline sells flight tickets in advance for future travel. | Recognize a contract liability until the passenger takes the flight. |

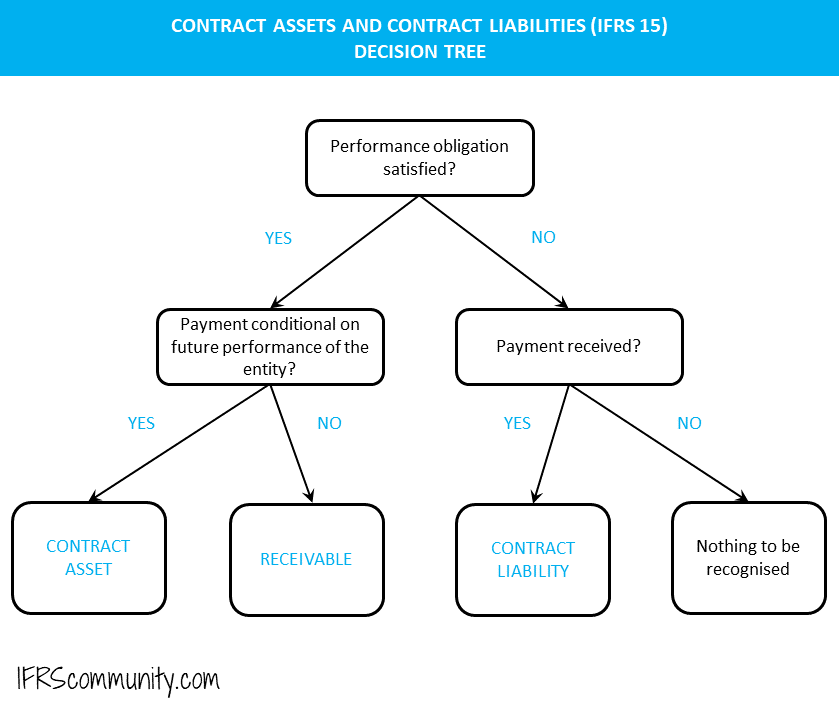

Decision Tree Approach for Classifying Contract Assets and Contract Liabilities

The following decision tree can help businesses determine whether a transaction should be classified as a contract asset or a contract liability.

Step 1: Has the Company Performed Any Work Under the Contract?

- Yes → Proceed to Step 2.

- No → If payment is received but no work is performed, classify it as a contract liability.

Step 2: Has the Company Recognized Revenue for the Work Performed?

- Yes → Proceed to Step 3.

- No → If no revenue is recognized but costs are incurred, reassess the performance obligations under IFRS 15.

Step 3: Has the Company Issued an Invoice for the Revenue Recognized?

- Yes → The company has an account receivable, not a contract asset.

- No → Proceed to Step 4.

Step 4: Is Payment Conditional on Future Performance Milestones?

- Yes → The transaction should be recorded as a contract asset.

- No → The company should recognize a receivable, not a contract asset.

Step 5: Has the Customer Paid Before the Delivery of Goods or Services?

- Yes → Classify the transaction as a contract liability.

- No → The revenue recognition process follows the normal IFRS 15 guidelines.

Examples of Contract Assets and Contract Liabilities in Different Industries

Example 1: Construction Industry (Long-Term Contracts)

A construction company enters into a two-year contract worth $5 million to build an office complex. At year-end, the company has completed 40% of the work but can only bill for 30% based on contractual milestone agreements.

| Transaction | Accounting Treatment |

|---|---|

| The company has completed 40% of the project but can only bill for 30%. | Recognize a contract asset for the remaining 10% work done that is not yet billable. |

| The company receives a $1 million advance payment before starting work. | Recognize a contract liability until the work is completed. |

Example 2: SaaS Industry (Subscription-Based Revenue)

A SaaS company offers an annual cloud storage plan for $1,200. Customers pay the full amount upfront before receiving access.

| Transaction | Accounting Treatment |

|---|---|

| The company receives full payment of $1,200 upfront. | Recognize a contract liability initially. |

| After one month, the company provides service for one month. | Recognize $100 in revenue, with the remaining $1,100 as a contract liability. |

Example 3: Manufacturing Industry (Custom Equipment Orders)

A company sells customized industrial equipment that requires a 50% deposit before production begins. The total contract value is $1 million.

| Transaction | Accounting Treatment |

|---|---|

| The company receives a $500,000 advance payment before production starts. | Recognize a contract liability until work begins. |

| The company completes 50% of the work but can only invoice at 75%. | Recognize a contract asset for the completed, unbilled portion. |

Best Practices for Internal Auditors Auditing Contract Assets and Contract Liabilities

1. Ensure Accurate Classification of Contract Balances

- Review whether contract assets and liabilities are properly classified based on the decision tree.

- Verify supporting documentation, including contracts, invoices, and customer payment schedules.

2. Conduct Substantive Testing of a Sample of Contracts

- Select contracts to ensure that contract assets are not overstated and that contract liabilities are properly deferred.

- Compare contract balances across different reporting periods to detect inconsistencies.

3. Validate Timing of Revenue Recognition

- Check that revenue is recognized only when performance obligations are met.

- Ensure that deferred revenue is reduced gradually as services are provided.

4. Assess Internal Controls Over Contract Management

- Determine if the company has clear policies for tracking contract modifications, prepayments, and performance obligations.

- Verify whether contract balances are properly accounted for in financial systems.

5. Review IFRS 15 Disclosure Requirements

- Ensure that financial statements include clear notes on contract assets and liabilities.

- Confirm that contract balances are properly disclosed under IFRS 15 compliance guidelines.

Conclusion: Enhancing IFRS 15 Compliance with a Decision Tree Approach

Contract assets and contract liabilities play a critical role in revenue recognition, impacting financial reporting accuracy and compliance. Internal auditors must ensure that these balances are properly classified, measured, and disclosed.

By using a decision tree approach, businesses can systematically assess whether a transaction results in a contract asset or liability, leading to more transparent and reliable financial statements.

As companies increasingly engage in subscription-based, milestone-driven, and long-term contracts, internal auditors must refine their audit strategies to ensure accurate revenue recognition and IFRS 15 compliance.

References

- IFRS Foundation. “IFRS 15: Revenue from Contracts with Customers.” IFRS.org

- Deloitte. “Understanding Contract Assets and Liabilities Under IFRS 15.” Deloitte Insights

- PwC. “Audit Considerations for Revenue Recognition Under IFRS 15.” PwC

![[IFRS 15] Contract Assets & Liabilities A Decision Tree Approach](https://govarix.io/wp-content/uploads/2025/02/IFRS-15-Contract-Assets-Liabilities-A-Decision-Tree-Approach.png)