Quick Commerce, or Q-Commerce, is redefining how consumers shop for essentials. With the promise of ultra-fast delivery—often under 30 minutes—it combines the best of traditional retail, e-commerce, and hyperlocal logistics. As urban lifestyles become busier and consumers grow accustomed to instant gratification, Q-Commerce is no longer a luxury—it’s becoming a necessity.

Check out business processes blogs by Govarix.

In this blog, we will break down the business model of Q-Commerce, discuss its operational ecosystem, highlight real-world examples, and explore the processes and strategies that fuel this rapidly growing industry.

What Is Quick Commerce?

Quick Commerce refers to the delivery of products—typically groceries, household essentials, and personal care items—within 10 to 30 minutes of placing an order. This is made possible through a network of dark stores (small fulfillment centers) placed strategically within urban areas, real-time inventory management, and a fleet of last-mile delivery partners.

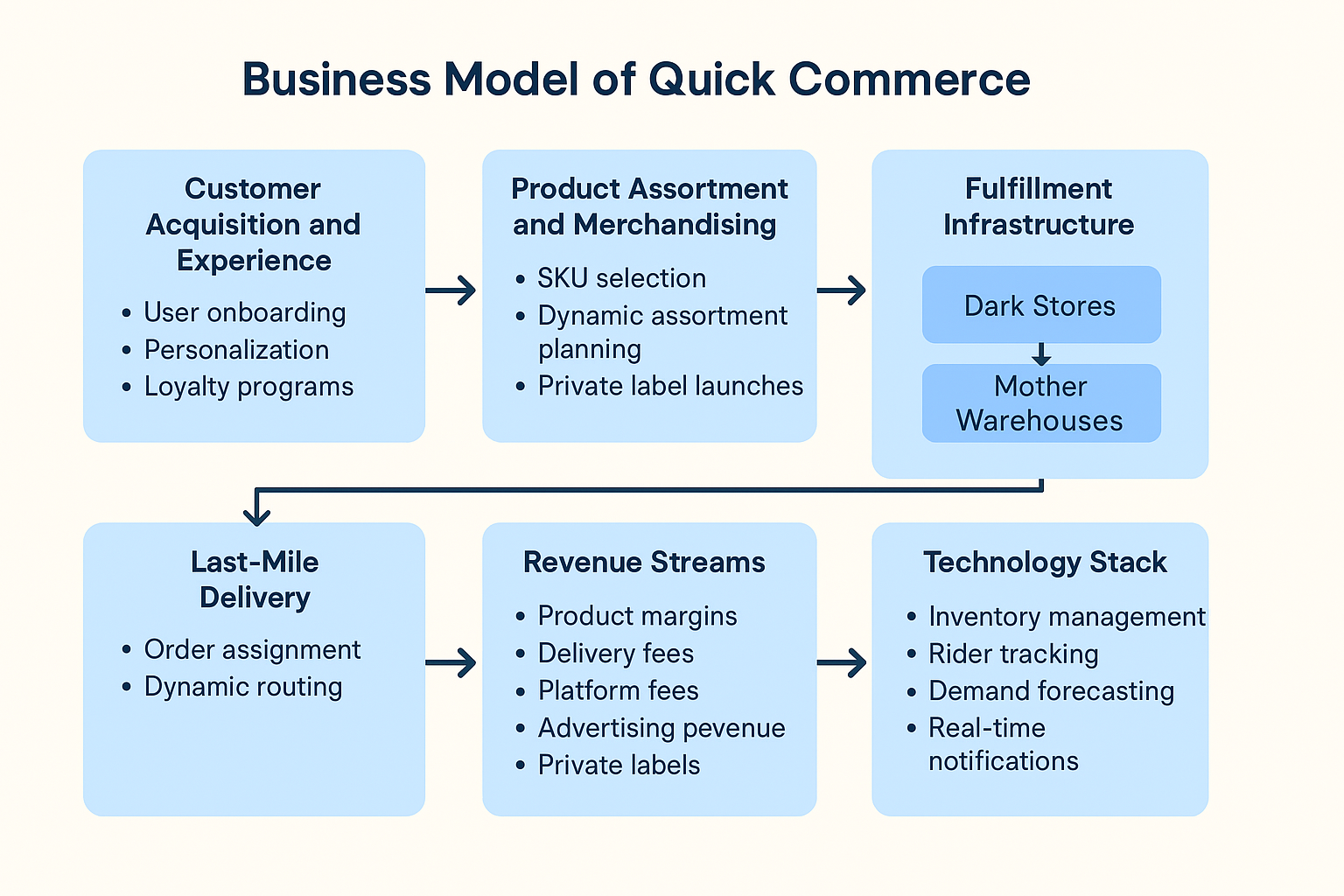

Key Components of the Quick Commerce Business Model

The overall eco-system of quick commerce can be further divided into multiple sub-processes.

Customer Acquisition and Experience

The front-end of any Q-Commerce platform is the app or website where customers browse products, place orders, and track deliveries.

Sub-processes

- User onboarding: Signup through mobile apps (e.g., Blinkit or Zepto)

- Personalization: Algorithms suggest items based on past purchases

- Loyalty programs: Subscriptions like Blinkit Max or Zepto Pass provide free delivery, cashback, and priority support

Example: Blinkit’s interface allows real-time updates of what’s available in a customer’s local dark store, adjusting SKUs in real-time based on stock.

Product Assortment and Merchandising

Quick Commerce thrives on offering a curated catalog of high-demand SKUs—typically 1,500 to 6,000 items—ranging from fresh produce to packaged goods.

Sub-processes

- SKU selection based on local demand

- Dynamic assortment planning (seasonal adjustments, flash sales)

- Private label launches for higher margins

Example: Zepto has launched its own line of bakery products and snacks to improve profitability while meeting local preferences.

Fulfillment Infrastructure

Dark Stores

These are micro-warehouses located in densely populated urban neighborhoods, often 1,500–3,000 sq. ft. in size.

Sub-processes:

- Inventory stocking

- Replenishment from mother warehouses (1–2 times daily)

- Order picking and packing within 2–3 minutes

Example: Swiggy Instamart operates 400+ dark stores across Indian cities with separate zones for fresh, frozen, and dry goods.

Mother Warehouses

Larger storage units located on the outskirts of cities that serve as the central hubs for replenishing dark stores.

Last-Mile Delivery

This is the most visible and critical component of Q-Commerce operations.

Sub-processes:

- Order assignment to the nearest delivery partner

- Dynamic routing based on traffic and weather conditions

- Delivery tracking and ETA updates

Example: Blinkit uses electric bikes for short-distance deliveries and ensures an average delivery time of 15–20 minutes in metros.

Revenue Streams

While the model is cost-intensive, Q-Commerce platforms generate revenue from multiple sources:

- Product margins: Slightly higher than offline retail due to volume discounts from FMCG brands

- Delivery fees: Charged below a minimum order threshold (e.g., ₹25–₹50)

- Platform fees: Applied during peak hours or small orders

- Advertising revenue: Sponsored listings by FMCG brands

- Private labels: Higher margins on in-house products

Example: JM Financial’s research reports Blinkit generates 3–4% of GMV through advertising and sponsored placements.

Technology Stack

Technology underpins the entire Q-Commerce value chain.

Sub-processes:

- Inventory and warehouse management software (WMS)

- Rider tracking and delivery time optimization

- AI-driven demand forecasting

- Real-time customer notifications

Example: Zepto uses machine learning to predict SKU-level demand for each store, which helps reduce stock-outs and wastage.

Challenges in the Q-Commerce Business Model

- Unit Economics and Profitability

While the sector shows promise, players often burn cash in the early stages due to:

- High last-mile delivery costs

- Warehouse setup expenses

- Customer acquisition and marketing overheads

Real-world note: Blinkit reduced its EBITDA loss from ₹326 crore in Q1 FY23 to ₹89 crore in Q3 FY24, showing a path to profitability.

- Supply Chain Complexity

Managing perishable goods with short shelf lives requires tight coordination between procurement, warehousing, and delivery.

- Operational Scalability

Scaling from 10 to 1,000 dark stores is not just about real estate—it demands:

- Standardized SOPs

- Efficient staff training

- High-order throughput systems

Opportunities Ahead

Below are the quick and immediate emerging opportunities for the quick commerce eco-system –

- Expansion to Non-Grocery Categories

Q-Commerce is expanding beyond groceries to include:

- Beauty and personal care

- Electronics (e.g., chargers, headphones)

- Pet food and accessories

- Hyperlocal Partnerships

Local stores, cloud kitchens, and D2C brands can partner with Q-Commerce players to reach more customers quickly.

Example: BigBasket’s BB Now allows small-scale merchants to distribute via its dark store network.

- Integration with ONDC

The Open Network for Digital Commerce (ONDC) in India could enable smaller Q-Commerce players to compete with giants by giving them digital infrastructure access.

Final Thoughts

Quick Commerce is more than just fast delivery—it’s an ecosystem of innovation in logistics, technology, customer engagement, and supply chain efficiency. While the road to profitability is steep, the potential for disruption is undeniable. With strong execution and robust infrastructure, Q-Commerce could reshape the way we shop for essentials, permanently.

References

- JM Financial Quick Commerce Report – February 2024

- Locus Blog: Quick Commerce Fulfillment Guide

- Roland Berger: Quick Commerce – A Lasting Revolution?

- IIMA Paper – Rise of Quick Commerce in India

- Statista: Online Grocery Market in India