Introduction

Fraud poses a significant threat to Australian businesses and government entities, costing millions annually in financial losses, reputational damage, and legal consequences. Auditors and business owners must proactively manage fraud risks by implementing robust assessment strategies. This guide provides practical insights, legal frameworks, and actionable steps to mitigate fraud risks effectively.

# A Practical Guide to Fraud Risk Assessment for Auditors & Business Owners in Australia: Legal Framework, Prevention Strategies, and Real-World Examples

Understanding Fraud and Its Impact

Fraud, as defined by the Commonwealth Fraud Control Policy, refers to “dishonestly obtaining a benefit, or causing a loss, by deception or other means.” It includes:

- Theft of assets or information

- Misuse of business funds or credit cards

- False invoicing and financial misrepresentation

- Employee fraud and corruption

- Cyber fraud (e.g., phishing and identity theft)

Impact of Fraud on Businesses

- Financial Losses: Unchecked fraud can result in massive financial damage.

- Legal Repercussions: Businesses can face lawsuits and regulatory penalties.

- Reputational Damage: Loss of public trust and investor confidence.

- Operational Disruptions: Fraud investigations can slow down business functions.

Legal Framework for Fraud Prevention in Australia

Businesses operating in Australia must comply with multiple fraud-related legal frameworks, including:

- Public Governance, Performance and Accountability Act 2013 (PGPA Act) – This Act mandates government entities to establish appropriate fraud risk assessment and control systems.

- Commonwealth Fraud Control Framework – A regulatory guide that requires agencies to develop fraud control plans, conduct risk assessments, and report fraudulent activities.

- Australian Consumer Law (ACL) – Businesses must not engage in misleading or deceptive conduct under Schedule 2 of the Competition and Consumer Act 2010.

- Crimes Act 1914 (C-th) & Criminal Code Act 1995 – Outlines penalties for fraud offenses, including imprisonment for up to 10 years for false documentation and misrepresentation.

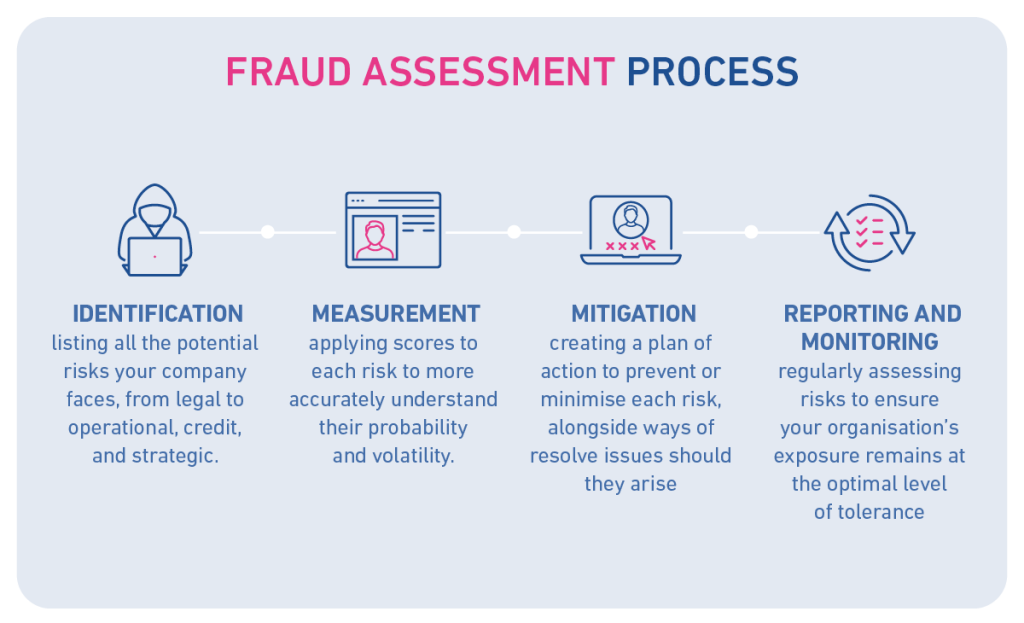

Key Steps in Conducting a Fraud Risk Assessment

A structured fraud risk assessment enables businesses and auditors to identify vulnerabilities and design appropriate controls.

Identify Potential Fraud Risks

Using techniques such as:

- Fraud Triangle Analysis (Opportunity, Pressure, Rationalization)

- Fraudster Personas (Deceivers, Impersonators, Exploiters, etc.)

- Industry-Specific Risk Mapping

Example: In the retail sector, fraudulent refund claims and inventory theft are common fraud risks.

Analyze & Evaluate Fraud Risks

Each identified risk must be analyzed based on:

- Likelihood: How probable is the fraud occurrence?

- Impact: What financial, legal, or reputational damage could it cause?

- Existing Controls: Are there effective fraud detection measures in place?

Fraud risks can be ranked using a Risk Analysis Matrix, categorizing them into Low, Medium, High, or Very High-risk levels. Learn more about planning an internal audit with our blogpost.

Implement Fraud Control Measures

Fraud controls should be SMART (Specific, Measurable, Achievable, Relevant, Time-bound) and categorized into:

- Preventive Controls: Employee training, internal policies, background checks.

- Detective Controls: Internal audits, fraud detection software, whistleblower programs.

- Responsive Controls: Legal action, recovery plans, fraud investigation teams.

Example: Banks implement two-factor authentication (2FA) as a preventive control against cyber fraud.

Continuous Monitoring and Auditing

Regular fraud risk reviews, audits, and pressure testing help organizations stay ahead of evolving fraud tactics.

Case Studies: Real-World Fraud Incidents in Australia

- Case Study 1: The Australian Government Grant Fraud – A business falsely claimed government grants for COVID-19 relief. Auditors detected the fraud through data analytics and cross-agency collaboration, leading to legal actions and recovery of misappropriated funds.

- Case Study 2: Corporate Procurement Fraud – A finance officer in a private company manipulated supplier payments to divert funds into personal accounts. Internal controls like segregation of duties and periodic forensic audits helped uncover the fraud.

- Case Study 3: Employee Payroll Fraud – An employee in a multinational firm created fictitious employees to siphon salaries into personal accounts. Automated payroll verification systems flagged irregularities, leading to a fraud investigation.

You can search on the internet for the detailed study on the above real-world incidents.

Leveraging Technology for Fraud Detection

Advanced fraud detection tools can strengthen risk assessment frameworks:

- AI-Powered Fraud Analytics: Identifies anomalies in financial transactions.

- Blockchain for Transparency: Ensures tamper-proof financial records.

- Machine Learning Algorithms: Predict fraud trends based on historical data.

- Cybersecurity Measures: Protect against phishing, hacking, and data breaches.

Best Practices for Business Owners & Auditors

When it comes to establishing or implementing a best-in-class practices for fraud risk assessment, it is essential to take into consideration the following horizons. This may be helpful for Internal Auditors or Business owners as well.

Develop a Strong Anti-Fraud Culture

- Establish a Fraud Prevention Policy.

- Conduct regular fraud awareness training for employees.

- Encourage whistleblower reporting mechanisms.

Strengthen Internal Controls

- Implement dual authorization for high-value transactions.

- Conduct unannounced audits and periodic fraud testing.

- Use secure financial software to minimize risks.

Legal Compliance & Reporting

- Maintain fraud risk registers as per PGPA Act requirements.

- Immediately report fraud incidents to Australian Federal Police (AFP) or Australian Securities and Investments Commission (ASIC).

- Consult forensic accountants and fraud risk consultants when dealing with suspected fraud.

A risk aware organization tends to survive and thrive more in the unfavorable circumstances.

Conclusion

Fraud risk assessment is not a one-time activity but a continuous process that requires vigilance, strategic planning, and the right technological tools. By following legal requirements, implementing fraud control measures, and leveraging fraud detection technologies, auditors and business owners in Australia can safeguard their organizations from financial and reputational risks.

By taking proactive fraud risk assessment measures, businesses can protect their assets, comply with legal obligations, and foster trust among stakeholders. Auditors play a crucial role in ensuring financial transparency and fraud resilience across industries in Australia.

References & Further Reading

- Commonwealth Fraud Control Framework: CounterFraud.gov.au

- Public Governance, Performance and Accountability Act 2013: Australian Government Legislation

- Crimes Act 1914 & Criminal Code Act 1995: Commonwealth Criminal Code

- Australian Competition & Consumer Commission (ACCC) – Fraud Reporting: ACCC Website

- ASIC Corporate Fraud Prevention: ASIC Website

- Top Strategies for Detecting and Preventing Fraud in Organizations